MATRIX SERVICE (MTRX)·Q2 2026 Earnings Summary

Matrix Service Q2 2026 Earnings: Revenue Beats, EPS Misses as Specialty Tank Issues Hit Margins — Stock Falls 6%

February 5, 2026 · by Fintool AI Agent

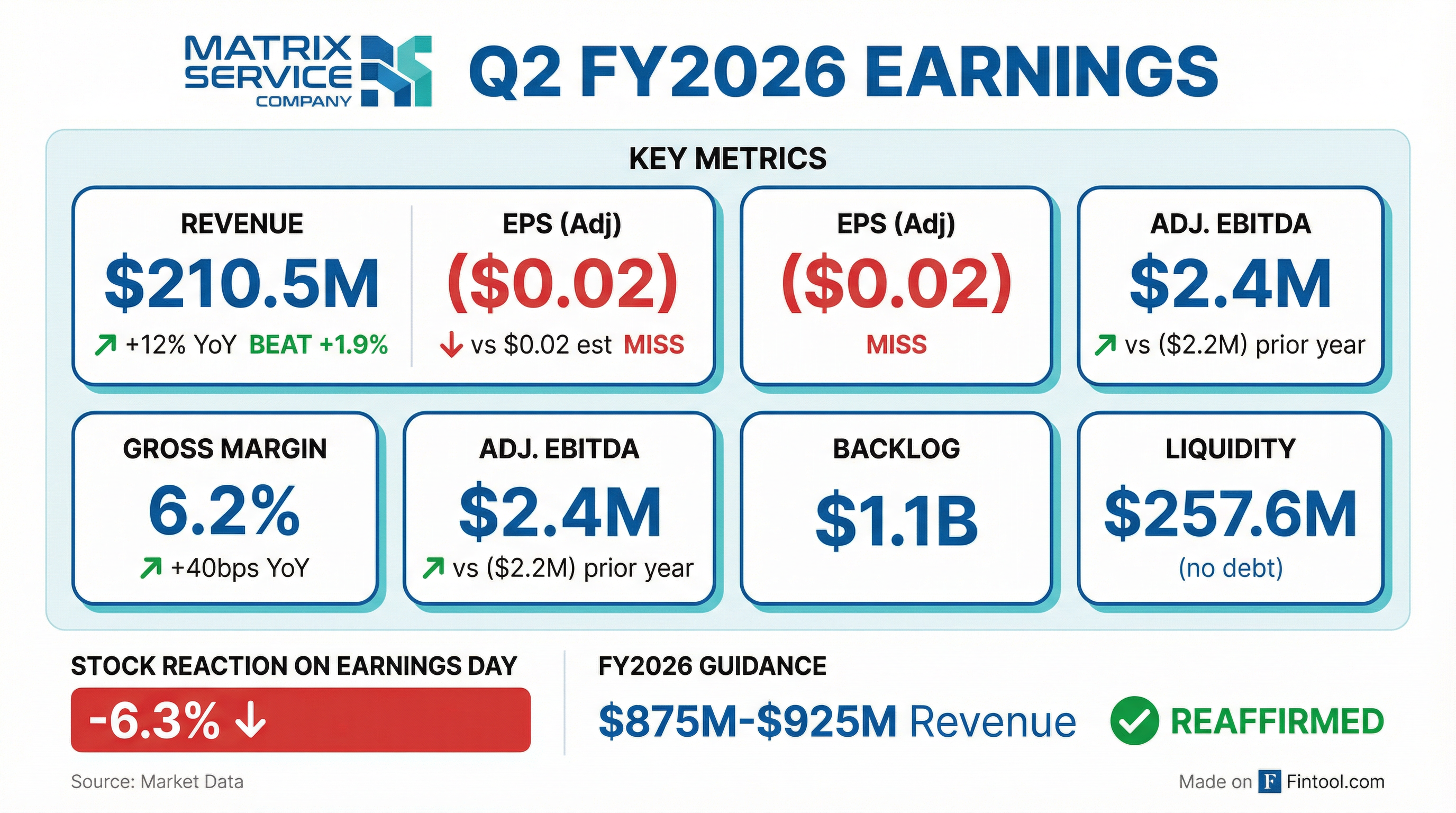

Matrix Service Company (NASDAQ: MTRX) reported Q2 FY2026 results that showed continued revenue growth but disappointed on profitability. Revenue of $210.5 million topped consensus by 1.9%, but EPS of -$0.03 missed the $0.02 expectation by a wide margin. The stock fell 6% on the news as investors focused on a $3.6 million hit from specialty tank commissioning issues and a book-to-bill ratio below 1.0x.

Did Matrix Service Beat Earnings?

The verdict: Revenue beat, EPS missed, stock punished.

Revenue increased 12% year-over-year, driven by higher volumes across all three segments. However, the bottom line was impacted by $3.6 million in costs from "warranty-type items" and "third-party commercial matters" arising during commissioning of specialty tank work in the Storage and Terminal Solutions segment.

Gross margin came in at 6.2%, up 40 bps YoY, but would have been 7.8% absent the specialty tank issues — a 1.6% headwind.

How Did the Stock React?

MTRX shares fell 5.7% on earnings day, closing at $13.50 versus a prior close of $14.32. The stock had been trading near 52-week highs around $14-15 heading into the print.

The selloff reflects investor disappointment with the EPS miss and concerns about the specialty tank execution issues, despite the revenue beat and reaffirmed guidance.

What Drove Segment Performance?

Matrix operates three segments, all of which grew revenue YoY:

Key takeaways by segment:

-

Storage & Terminal Solutions (48% of revenue): The largest segment grew only 5% due to lower crude oil project volumes offsetting LNG/NGL growth. More importantly, the $3.6M specialty tank commissioning costs crushed gross margin from 7.6% to 4.8% — a 280 bps headwind.

-

Utility & Power Infrastructure (36% of revenue): The star performer with 23% revenue growth driven by power delivery and natural gas peak shaving projects. Gross margin expanded 400 bps to 9.6% on strong project execution.

-

Process & Industrial Facilities (17% of revenue): Solid 15% growth from higher refinery turnaround volumes. Margin improved 230 bps to 3.5%.

What Did Management Guide?

Guidance reaffirmed — no changes.

CEO John Hewitt emphasized confidence in the second-half ramp: "Looking to the second half of the fiscal year, we continue to expect improving profitability, driven by higher volumes in our Storage and Terminal Solutions segment. The business remains on track to achieve our full-year guidance."

With H1 revenue at $422.4M, the guidance implies H2 revenue of $453-503M — a 7-19% acceleration from H1. Management expects improved overhead absorption as backlog converts.

What Changed From Last Quarter?

Sequentially, the story is mixed:

- Net loss narrowed significantly from -$3.7M to -$0.9M

- Gross margin contracted due to the specialty tank issues

- Backlog declined $34M as book-to-bill came in at 0.8x

Is the Backlog Concerning?

Backlog of $1.13 billion remains robust, but the 0.8x book-to-bill signals near-term awards softness.

Management noted this was expected and provided color on timing. CEO Hewitt used an NFL analogy: "Chunk plays — the big chunk projects that really drive that big book-to-bill in a quarter — they're out there, we're positioned for them. Those big chunk projects are the ones we're gonna see in our award cycle in fiscal 2027, which starts July 1."

The $7.3 billion opportunity pipeline (up $600M from last quarter) provides comfort that awards should rebound. Management emphasized projects aren't being lost to competitors — they're simply delayed due to permitting and trade policy uncertainty.

What's the Balance Sheet Position?

Matrix maintains a fortress balance sheet with no debt:

The strong liquidity position supports both organic growth initiatives and potential M&A. Management has historically used the balance sheet for tuck-in acquisitions (PDM Engineering, Kvaerner NAC, Baillie Tank Products, Houston Interests).

Key Management Commentary

CEO John Hewitt delivered bullish commentary on the "generational investment cycle" driving the business:

"Matrix and our entire sector has experienced a once-in-a-generation surge in demand for critical energy, power, rare earth, and industrial infrastructure. We firmly believe we are still in the early stages of this transformative build-out."

On the power shortage and AI data center demand:

"The shortage of reliable, cost-effective power generation has steadily intensified nationwide, and the surge in demand from AI data centers, which require continuous and substantial power, has only compounded this issue. The United States is now critically short of affordable, reliable electric generation."

"Crucially, the global race for AI dominance hinges on electricity availability. Governments increasingly recognize that this is not merely a matter of business efficiency or quality of life, but at its core, a national security imperative."

On natural gas demand:

"Demand for natural gas, widely recognized as the essential bridge fuel for a cleaner energy future, has soared by over 100%, while pipeline capacity has grown by only 50%."

On the specialty tank issues:

"Costs associated with warranty-type items, as well as certain third-party commercial matters, arising during commissioning of specialty tank work resulted in a $3.6 million reduction in gross profit during the quarter."

CEO Transition Announced

Matrix announced a CEO transition that has been in the works as part of an active succession plan. John Hewitt will step down as CEO on June 30, 2026, after working alongside Shawn Payne for nearly 30 years. Payne was promoted from President of E&C to Chief Operating Officer in February 2026 and will assume the CEO role on July 1, 2026.

Hewitt emphasized confidence in his successor: "Shawn is a proven leader with exceptional operational expertise and unwavering commitment to our people and our stakeholders. He has been instrumental in the growth of our backlog, our business turnaround, organizational streamlining, and strategic planning."

Q&A Highlights: What Analysts Asked

On the $3.6M Specialty Tank Issue — Analyst John Franzreb (Sidoti) asked if costs would bleed into Q3. CFO Kevin Cavanah confirmed: "We think we've captured the issues associated there, and would not expect anything bleeding over into the third quarter. We think we've got our hands around what the issues are and a path to get them resolved."

On the Opportunity Pipeline Growth — The $7.3B pipeline is up ~$600M (10%) from last quarter. Management noted growth is coming from LNG/NGL markets, mining and minerals, and electrical infrastructure.

On Weak Bookings — CEO Hewitt explained the 0.8x book-to-bill: "The overall volume of project awards has been tempered due to uncertainty around trade policy, permitting, and the government shutdown that occurred in late 2025. This uncertainty has delayed FIDs and award progression on many projects." He emphasized these are timing delays, not lost opportunities: "It's not a high percentage of them that are getting won by competitors."

On Data Center Opportunities — Analyst Brent Thielman (D.A. Davidson) pressed on the data center power theme. Hewitt clarified: "Matrix does not build the data center or advanced manufacturing facility. However, we do build the required critical energy infrastructure needed to power them." He added they're "already bidding projects from an electrical infrastructure standpoint on new substations that are directly connected to a data center power needs" and hopes to add some to backlog in H2 FY26.

On Mining & Minerals — An emerging growth area: "We've got a couple of really nice projects that we're bidding now in the mining and minerals market... copper, rare earth minerals, gold. Besides the demand for those non-ferrous metals related to all this infrastructure build-out, you've also got the federal government now investing money in rare earth minerals from a national security issue."

On Margins & Competition — Asked if new jobs are being written at target margins, Hewitt confirmed: "Our work that we're booking on a collective basis is falling within our targeted margin ranges... it's not the same as three years ago, where contractors are out chasing projects and driving margins to the bottom." Target margin range is 10-12%, with some pieces at the high end or above.

On Capital Allocation — Regarding share buybacks with $225M+ cash on the balance sheet: "We're gonna be focused on catch-up internal investment, looking for inorganic opportunities that round out our business offering. The inability to find inorganic opportunities could result in us making the decision that maybe we buy back shares. All that stuff's on the table."

Historical Financial Trends

Sources: S&P Global

Revenue has grown consistently from the ~$165M trough, now reaching the $210M+ range. The path to profitability remains elusive but losses are narrowing.

Forward Catalysts

Near-term (Next 1-2 quarters):

- H2 FY26 revenue acceleration to hit $875-925M guidance

- Resolution of specialty tank commissioning issues

- Storage & Terminal Solutions margin recovery

Medium-term:

- LNG infrastructure build-out driving multi-year visibility

- Data center and advanced manufacturing power demand

- Potential M&A with $250M+ net cash position

Risks to Watch:

- Book-to-bill remaining below 1.0x

- Further execution issues on specialty projects

- Trade policy uncertainty impacting project timing

- CEO transition execution risk

Bottom Line

Matrix Service delivered a mixed Q2 — revenue topped expectations but EPS missed due to one-time specialty tank issues. The 6% stock selloff seems overdone given the reaffirmed guidance and strong balance sheet, but investors are rightfully cautious about execution risk after the margin disappointment. The thesis hinges on H2 profitability improvement as backlog converts at higher margins. Watch the Q3 print closely for signs the specialty tank issues are truly behind them.

Related Resources: